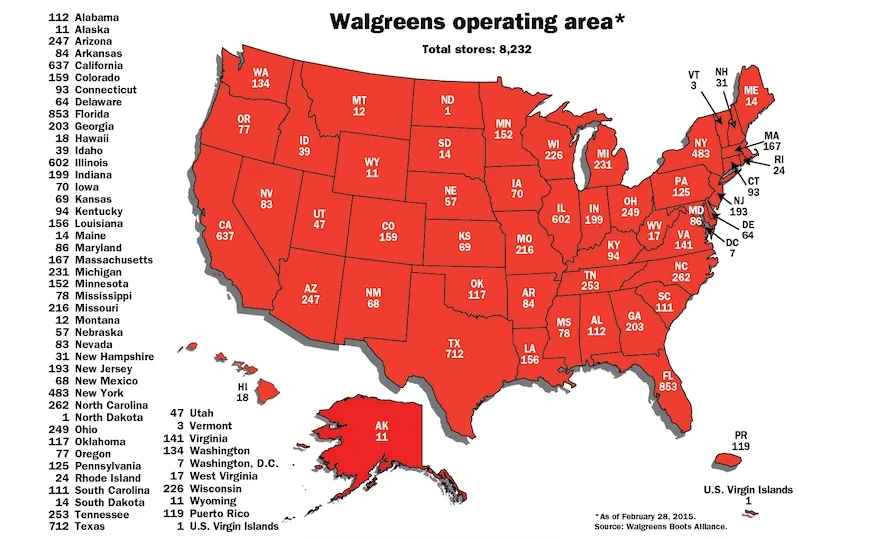

By the numbers at least, a look at the map gives some idea of where Rite Aid will help fill out Walgreens’ national store network, if the blockbuster deal by Walgreens Boots Alliance (WBA) to acquire the Camp Hill, Pa.-based drug chain goes through.

Walgreens, which already has stores in all 50 states, has said that the addition of Rite Aid will fill gaps in the Northeast and Southern California. In California overall, Rite Aid has 577 stores (as of April 1), while Walgreens has 637 stores (as of Feb. 28).

The Northeast and Mid-Atlantic appear to be where Rite Aid will bring the biggest benefit in coverage for Walgreens (see store maps below).

Rite Aid has significantly more stores than Walgreens in Michigan, Pennsylvania, West Virginia, Virginia, Maryland, New Jersey, New York, Rhode Island, Vermont, New Hampshire and Maine. Of note: In New York state, roughly half of Walgreens’ locations are Duane Reade stores in the New York City metropolitan area.

States where Walgreens and Rite Aid have a comparable number of stores, based on the maps below, include Washington, Oregon, Kentucky, Alabama, Georgia, South Carolina, Ohio, Connecticut and Masschusetts, plus the District of Columbia.

WBA has indicated that it’s willing to divest up to 1,000 stores to gain regulatory approval for the Rite Aid acquisition but expects divestitures to be less than half that number.

Together, Walgreens and Rite Aid would create a chain drug retailer with more than 12,700 stores. Based on the latest numbers, Walgreens has 8,173 stores in 50 states, the District of Columbia, Puerto Rico and the U.S. Virgin Islands. Rite Aid has 4,561 stores in 31 states and D.C.

In a research note on Tuesday, Deutsche Bank Securities analyst George Hill said there are “some interesting wrinkles” to the Walgreens-Rite Aid merger agreement.

“Maybe most notable is the two-step breakup fee, where Walgreens pays Rite Aid a $325 million breakup fee if it cannot obtain regulatory approval for the deal, but it pays $650 million if it cannot complete the deal because it announces or makes other ‘certain transactions’ within eight to 12 months of merger agreement. We see this as Walgreens preserving its optionality, potentially around a large PBM deal,” Hill wrote.

“Walgreens indicates in the merger document that it is willing to divest up to 1,000 pharmacy locations of the combined company (~7.8% of total combined stores), or non-store divestitures limited to $100 million based on fair value of non-earning assets plus annual EBITDA from earning assets,” he added. “In its marketing presentation to investors, Walgreens notes that it believes it would likely have to divest less than 500 stores. The company also touts the value of an expanded network for its customers, potential cost savings and the ability to expand Boots’ product distribution into Rite Aid locations.”

Rite Aid’s store base is concentrated on the East And West Coasts.

Walgreens covers the entire U.S. with its store network.