NEW YORK — Three of the largest U.S. companies — Berkshire Hathaway, Amazon and JPMorgan Chase & Co. — have joined together to take employee health care into their own hands.

Berkshire Hathaway, Amazon and JPMorgan Chase said Tuesday that they plan to form an independent health care company to provide their employees accessible, affordable and quality care. Characterized as a long-term effort, the corporate giants said they initially aim to focus on technology solutions that offer workers and their families basic, high-quality and transparent health care “at a reasonable cost” but have an overarching goal of improving employee satisfaction and reducing costs.

“The ballooning costs of health care act as a hungry tapeworm on the American economy. Our group does not come to this problem with answers. But we also do not accept it as inevitable,” Berkshire Hathaway chairman and chief executive officer Warren Buffett said in a statement. “Rather, we share the belief that putting our collective resources behind the country’s best talent can, in time, check the rise in health costs while concurrently enhancing patient satisfaction and outcomes.”

Warren Buffett

So far, the employee health care partnership is only in the early planning stages. Berkshire Hathaway, Amazon and JPMorgan Chase said the formation of the company is jointly led by Todd Combs, an investment officer at Berkshire Hathaway; Marvelle Sullivan Berchtold, a managing director at JPMorgan Chase; and Beth Galetti, a senior vice president at Amazon.

The companies added that the longer-term management team, headquarters and key operational details will be communicated at a later time.

Though the three companies admit they don’t come to the venture with ready-made solutions for the health care dilemma, they said they can leverage their scale, collective experience and resources, and complementary expertise to bring a fresh approach to the problem.

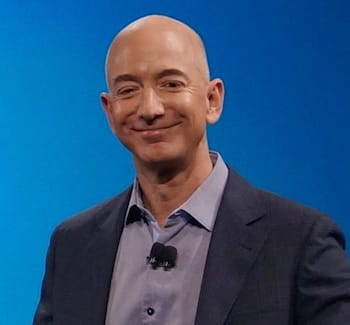

That includes thinking out of the box, according to Amazon founder and CEO Jeff Bezos.

“The health care system is complex, and we enter into this challenge open-eyed about the degree of difficulty,” Bezos noted. “Hard as it might be, reducing health care’s burden on the economy while improving outcomes for employees and their families would be worth the effort. Success is going to require talented experts, a beginner’s mind and a long-term orientation.”

Jeff Bezos

Jamie Dimon, chairman and CEO of JPMorgan Chase, pointed out that a linchpin of solutions forthcoming from the partnership will be to empower their employees to take charge of their own health care.

“Our people want transparency, knowledge and control when it comes to managing their health care,” Dimon stated. “The three of our companies have extraordinary resources, and our goal is to create solutions that benefit our U.S. employees, their families and, potentially, all Americans.”

The high-profile partnership underscores the fact that companies and their employees aren’t satisfied with current health care choices and are still searching for more cost-savvy, convenient and effective options.

“Longer term, we view this partnership as something that could be a more active version of the Health Transformation Alliance (HTA),” Jeffries analyst Brian Tanquilut said in a research note released Tuesday. Announced in early 2016, the HTA started with 20 large public companies looking to cut their health care spend and improve employee health outcomes by purchasing health services as a consortium. It now includes over 40 companies representing some 6 million lives, he noted.

“As we look at today’s partnership announcement, we see the opportunity for Amazon-JPMorgan Chase-Berkshire Hathaway to contract and negotiate directly with providers (i.e. JPMorgan Chase already negotiates directly with hospitals in some markets), and incorporate more proactive services and technology-enabled capabilities (either internally developed or acquired) that could bring down costs and improve overall health care quality (e.g. price transparency, telemedicine, technology-driven pharmacy benefit management),” Tanquilut wrote.

In the chain drug retail arena, three of the leading players — CVS Health, Walgreens Boots Alliance (WBA) and Rite Aid Corp. — continue to retool their businesses to offer more affordable, coordinated care, positioning well-managed pharmacy care as key to improved patient health outcomes.

CVS Health made the biggest splash recently with its $69 billion deal to acquire health insurer Aetna Inc., announced in early December.

Jaimie Dimon

According to executives from both companies, the CVS-Aetna merger can fill gaps in the nation’s health care system and redefine access to high-quality care in lower-cost, local settings, as well as at home or via digital tools. CVS already has been touting a more holistic approach to care with its integrated business model, which includes the CVS Pharmacy drug chain, MinuteClinic walk-in medical clinic operation and CVS Caremark pharmacy benefit manager.

WBA, too, has looked to drive innovative care solutions with such initiatives as the AllianceRx Walgreens Prime joint venture with PBM Prime Therapeutics LLC. Unveiled in August 2016 and officially launched this past October, AllianceRx Walgreens Prime created a joint pharmacy services company by combining the Walgreens’ and Prime’s central specialty pharmacy and mail service businesses.

Executives noted that the venture joins Prime’s PBM expertise with the reach and operating efficiencies of Walgreens’ more than 8,000 drug stores, enabling the pharmacy, PBM and health plans to better coordinate patient care to produce better health outcomes and rein in costs.

And Rite Aid is keen on the potential synergies and models of care offered by its 2015 acquisitions of EnvisionRxOptions, a diverse health care company led by the EnvisionRx PBM; Health Dialog, a population health management, health care analytics and health coaching firm; and convenient care clinic operator RediClinic. Executives said these businesses open up new cost-efficient and effective pharmacy and health care offerings for employers, employees and payers and form a foundation for Rite Aid’s transformation following the sale of much of its drug store base to WBA this past September.

Editor’s Note: Article updated with analyst comment.