Automation isn’t new, but it is time to think about it in a new way: as an important opportunity to transform pharmacists’ work, attract more talent and make retail pharmacy businesses viable for the long term.

Rodey Wing

While some industries are just beginning to explore automation, pharmacies have been using it since the 1960s. Automation and centralization started as a cost-savings play, but these days it can be used to accelerate the necessary shift to new business models for pharmacies. Automation is inevitable, so instead of fighting it, it’s time to welcome the chance to use it to reshape the retail pharmacy business.

A more automated future can improve the customer experience, create better experiences for pharmacy staff and build a more sustainable business model, even in a complicated health care and regulatory ecosystem. The pharmacies that meet this new moment of automation have the opportunity to thrive. Those that don’t will surely struggle with low employee engagement, high attrition, waning customer satisfaction and payment models with diminishing returns. Automation can be a win-win-win for pharmacy businesses, pharmacists and customers — if the strategy is intentional about acknowledging the new value and if business leaders embrace the change.

Laura Bowen

It’s time for the pharmacist’s role to evolve

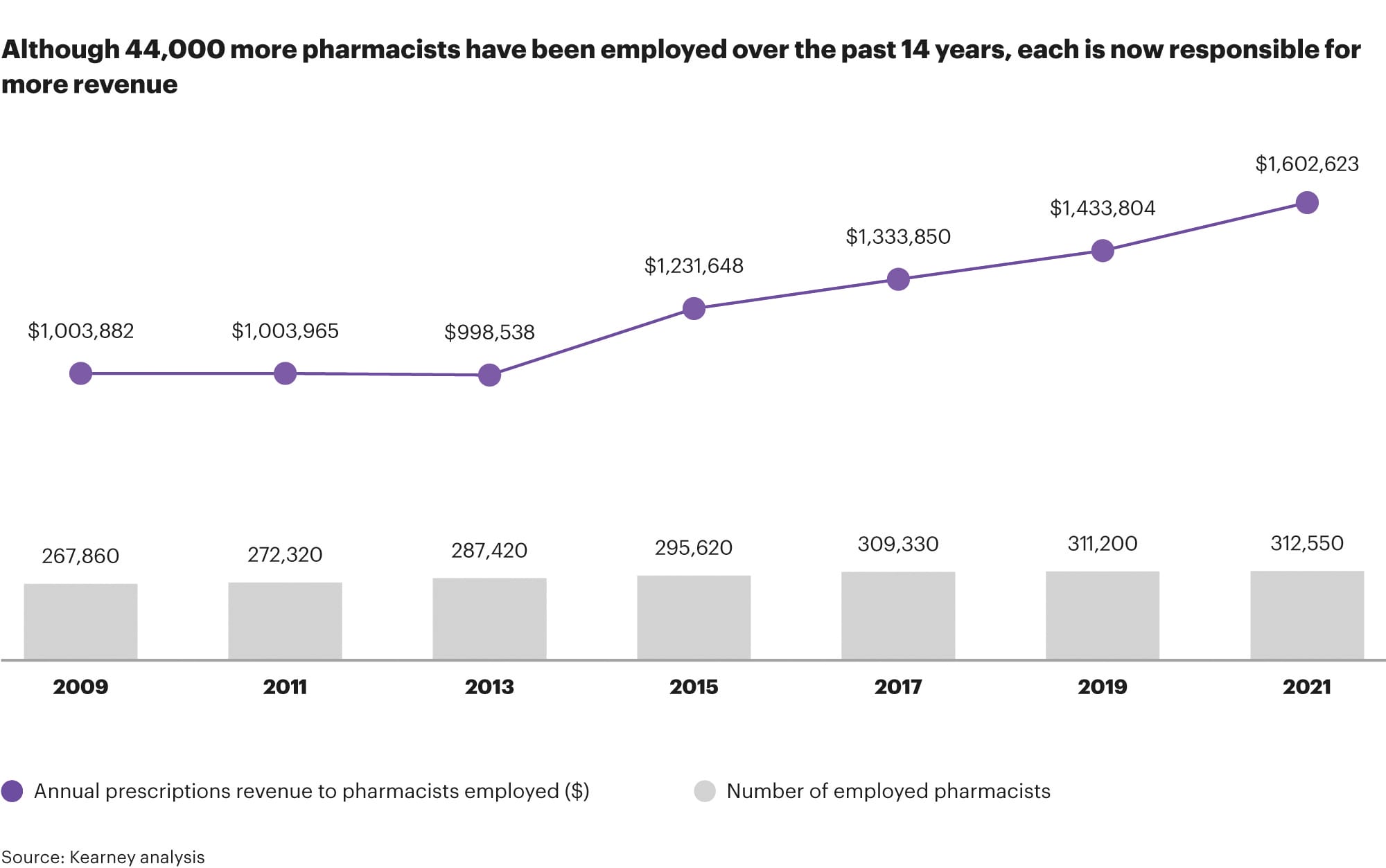

Forward-thinking companies are reexamining the pharmacist’s role and the employee experience. The job has become more stressful, with pharmacists under more pressure to serve more patients and dispense a higher volume of medications. Yet, under the current operating model of corner drug stores, their wages have been stagnant — increasing by less than $20,000 in 15 years despite inflation, higher levels of employment and more job pressures.

As a result, fewer people are pursuing pharmacy careers, which require six years of higher education. The career’s growth rate has slowed in recent years: Projections show only 2% growth from 2021 to 2031 — slower than the average for all occupations. According to a National Community Pharmacists Association survey, two-thirds of community pharmacies are struggling with labor shortages and filling open positions. And starting in March 2023, CVS and Walgreens have shortened their pharmacy hours to adjust to the labor shortage.

With these labor shortages, working pharmacists are facing heavier workloads, leading to burnout and a lack of employee satisfaction. As a result, it’s time for employers to consider automation as a solution to the industry’s attrition issue and adjust the employee value proposition to make pharmacists happier.

Dispensing has become commoditized

Sarah Scolnic

The essential element of pharmacy service is dispensing prescription medications: putting the correct number of the right pills in the bottle for the right patient. But private and government payors view the function as commoditized and have decreased reimbursement rates. As a result, the share of retail pharmacy profits has been declining in the U.S. drug value chain, from 17% in 2016 to 13% in 2020. Despite prescription revenue almost doubling over the past 15 years, the profit margin on prescription drug sales is decreasing because of low reimbursement rates. In fact, reimbursement rates for retail pharmacies have been declining by 3% to 5% each year for the past several years. In addition, pharmacy benefit managers have been facing more pricing pressure from plan sponsors, regulators and policy makers to keep drug costs down and prove that they deliver value, so the landscape isn’t expected to improve. And finally, as noted, the labor market is shrinking. More pharmacists are moving into clinical and hospital settings, leaving fewer pharmacists to fill prescriptions in retail settings. A critical look reveals that dispensing medications is not an area of revenue growth.

Because of this challenging financial landscape, many pharmacy businesses have expanded automation and centralized dispensing to cut costs and take workflow out of stores. That investment proved to be business-critical during the COVID-19 pandemic, when many pharmacies were short-staffed and struggled to meet patients’ changing needs. Now, pharmacies are entering a new era in which most of the tactical work of dispensing can be done by robots, with human pharmacists providing the final layer of clinical review. And at this point, automated dispensing is about more than cost savings; it’s about elevating pharmacists — who are highly trained specialists — to do more of the high-touch clinical work of interacting with patients and dispensing medical advice. In addition, automation will allow businesses to explore new revenue streams based on that pharmacist-patient relationship.

The win-win-win solution

To meet patients’ needs in this environment of low reimbursement rates and staffing challenges, one clear answer is using robots to automate dispensing and make the process more efficient. Collaborative robots (known as “cobots”) work alongside people in a shared workspace in tedious, hazardous environments so human workers can focus on tasks that require reasoning and resourcefulness. For example, cobots are transforming the automotive industry by automating repetitive or dangerous aspects while allowing humans to handle more complex, creative tasks. In factories, cobots can do the heavy lifting while humans do the rest, and humans and cobots are working side by side on some assembly lines. Cobots could have similar applications in other industries, including pharmacies. In centralized dispensing sites, robots and cobots can dispense prescriptions rapidly, with a human pharmacist providing the final clinical review for accuracy.

Explore new value-add services

If automation allows the retail pharmacist’s role to shift away from dispensing, the pharmacist will have more capacity for value-add services that improve the patient experience and the overall quality of care — and open up new revenue streams. For example, pharmacists could spend more time on medication therapy management — consulting with patients to make sure medications are right for their health conditions and that they get the best possible outcomes from treatment. Both patients and payors value this service from pharmacists. For example, in Canada, pharmacists’ scope has expanded to include renewing, refusing to fill, adjusting and substituting prescriptions; initiating drug therapy for specific conditions; ordering and interpreting laboratory tests; and administering injections and vaccines.

This shift from dispensing to health care services does come with a couple caveats:

- Regulations in some states don’t allow pharmacists to complete service activities. Shifting those regulations would require heavy lobbying.

- Payor relationships are crucial when setting up new revenue streams around services. Pharmacy business leaders will need to ensure that payors value and will pay for services and avoid letting them become commoditized.

Consider the opportunities that automation offers

The shift to pharmacy automation could be a win-win-win for everyone involved: the business, pharmacists and patients. However, successfully utilizing automation will require the right mindset and the right framing for business leaders. Many pharmacies already invest in automation but need to reframe the investment business case. Automation isn’t just a cost-cutting play; it can also bring in more revenue. Leaders should ask: Are we investing for the right reasons and in the right areas of the business?

Automation can create a financial benefit to the business; an employee retention and satisfaction benefit to pharmacists; and a speed, efficiency and personal touch benefit for patients, who could get prescriptions filled faster and get more face time with pharmacists they trust.

Companies that don’t invest in automation, become more efficient and develop service revenue streams to expand their employee value proposition run the risk of their business dying in a competitive labor market where pharmacists have other options. How will retail pharmacies create an employee value proposition that’s compelling?

Automation will bring an inevitable shift to an industry that is running out of good options in the current model. The robots aren’t coming for retail pharmacists’ jobs. They’re saving them.

Rodey Wing is a partner in the Healthcare & Life Sciences practice at Kearney, a global strategy and management consulting firm. He can be reached at rodey.wing@kearney. Laura Bowen is a principal in the Healthcare & Life Sciences practice at Kearney. She can be reached at laura.bowen@kearney.com. Sarah Scolnic is a principal in the Healthcare & Life Sciences practice at Kearney. She can be reached at sarah.scolnic@kearney.com.