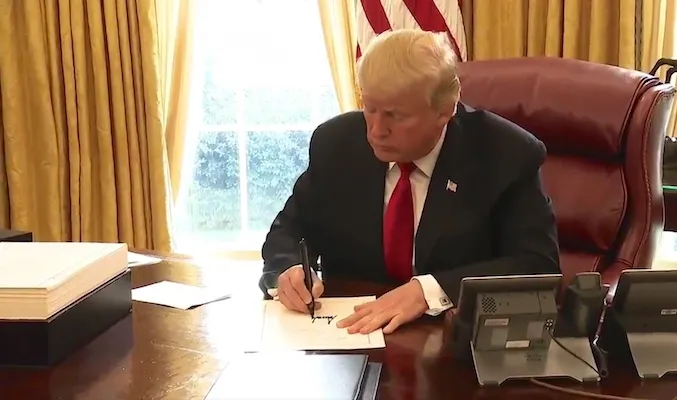

President Donald Trump signed the tax reform legislation just before the holiday break.

WASHINGTON — The individual mandate is no more.

The requirement under the Affordable Care Act that people pay a penalty if they do not obtain health insurance was eliminated in the federal tax overhaul passed by Congress.

After the Senate approved the tax reform legislation 51-48, Trump tweeted, “Terrible Individual Mandate (ObamaCare) Repealed.” He signed the congressional tax bill on December 22.

The implication of the mandate’s end for the overall ACA is uncertain. Supporters of the requirement said its elimination — which takes effect in 2019 — will result in higher premiums and lower enrollment in plans. They said that discarding the penalty — a minimum of $695 for an adult — will especially lead younger, healthier people to forgo insurance. And those are the people that insurers rely on to offset the cost of covering older and sicker Americans.

But just how much premiums will rise and sign-ups will drop is subject to debate. The Congressional Budget Office projected that without the mandate, premiums will increase by 10% and 4 million fewer people will be insured in 2019 and 13 million fewer by 2027. At the same time, the CBO estimated that the requirement’s elimination would save the government more than $300 billion that it would otherwise have paid out in insurance subsidies and for Medicaid recipients. And taxpayers will save $43 billion in penalties, according to the office.

Sen. John Barrasso (R., Wyo.), called the mandate “one of the most unfair parts of Obamacare.” Passage of the tax package “means Americans will no longer pay a penalty if they decide that overpriced Obamacare insurance is not right for them,” he said.

Ohio Democrat Sherrod Brown countered that many people would pay more in higher premiums than they would obtain in tax cuts. “Washington chose to cut taxes for millionaires and corporations and pay for it by cutting Medicare and kicking people off their health insurance,” he said.

Trump with congressional leaders after Congress passed the tax reform bill.

The tax package lowers the corporate tax rate to 21% from the current 35%, a move that the GOP says will drive growth, create jobs and hike wages. Individuals will see the top tax rate drop to 37% from 39.6%. Inherited money protected from estate taxation has been doubled, to $22 million for married couples, and owners of pass-along businesses, whose profits are taxed through the individual code, can deduct 20% of their business income.

B. Douglas Hoey, chief executive officer of the National Community Pharmacists Association, praised the tax bill for removing succession planning burdens. “Like many small businesses, independent pharmacy is often a family affair with children following in the footsteps of their parents,” he said. “There are countless examples of independent pharmacies being owned and operated by a single family through multiple generations. By doubling the estate tax exemption, this legislation will encourage such family traditions and ownership to continue, and we enthusiastically support its inclusion.”

Matthew Shay, president and chief executive officer of the National Retail Federation, said, “Passage of tax reform is a major victory for retailers who currently pay the highest tax rate of any business sector, and for the millions of consumers they serve every single day. Our priorities were clear: reform must jump-start the economy, encourage companies to invest here in the United States, increase wages and expand opportunities for employees, and protect our small business community, of which the vast majority are retailers. That’s exactly what this legislation will achieve. Most importantly, this historic tax reform will put more money in the pockets of consumers — the best Christmas gift middle class Americans could ask for this holiday season.”

For the ACA, while expunging the individual mandate may not be its death knell, the action builds on other Trump administration efforts to weaken the law. Those include eliminating some insurance subsidies, cutting the enrollment period for plans in half, eviscerating the Obamacare marketing campaign, and allowing bare bones coverage.

“They obviously couldn’t kill it, so they’re trying to starve it slowly,” Rep. Bill Pascrell (D., N.J.), was quoted as saying in Politico.

At the same time, polls are demonstrating increasing public approval of the ACA. Jon Kingsdale, who ran the Massachusetts health exchange, called the statute “wounded,” but noted that its basic structure, including online marketplaces, consumer protections and subsidies, have survived, along with the Medicaid expansion that added 12 million people to the number of insured Americans.

That notwithstanding, the ACA repeal effort is hardly dead. “I think we’re all going to say that we ripped the heart out of Obamacare with the individual mandate,” said Sen. Lindsey Graham (R., S.C.), according to Politico. “It’s pretty hard to rip the heart out of it and not replace it.”

Even a bipartisan approach to health insurance was seen as a possibility. “Arguably, doing away with the individual mandate makes the Affordable Care Act unworkable — not that it was particularly great beforehand,” Politico reported Sen. John Cornyn (R.,Texas) saying “So I think ultimately this will precipitate a bipartisan negotiation on what we need to do as an alternative.”