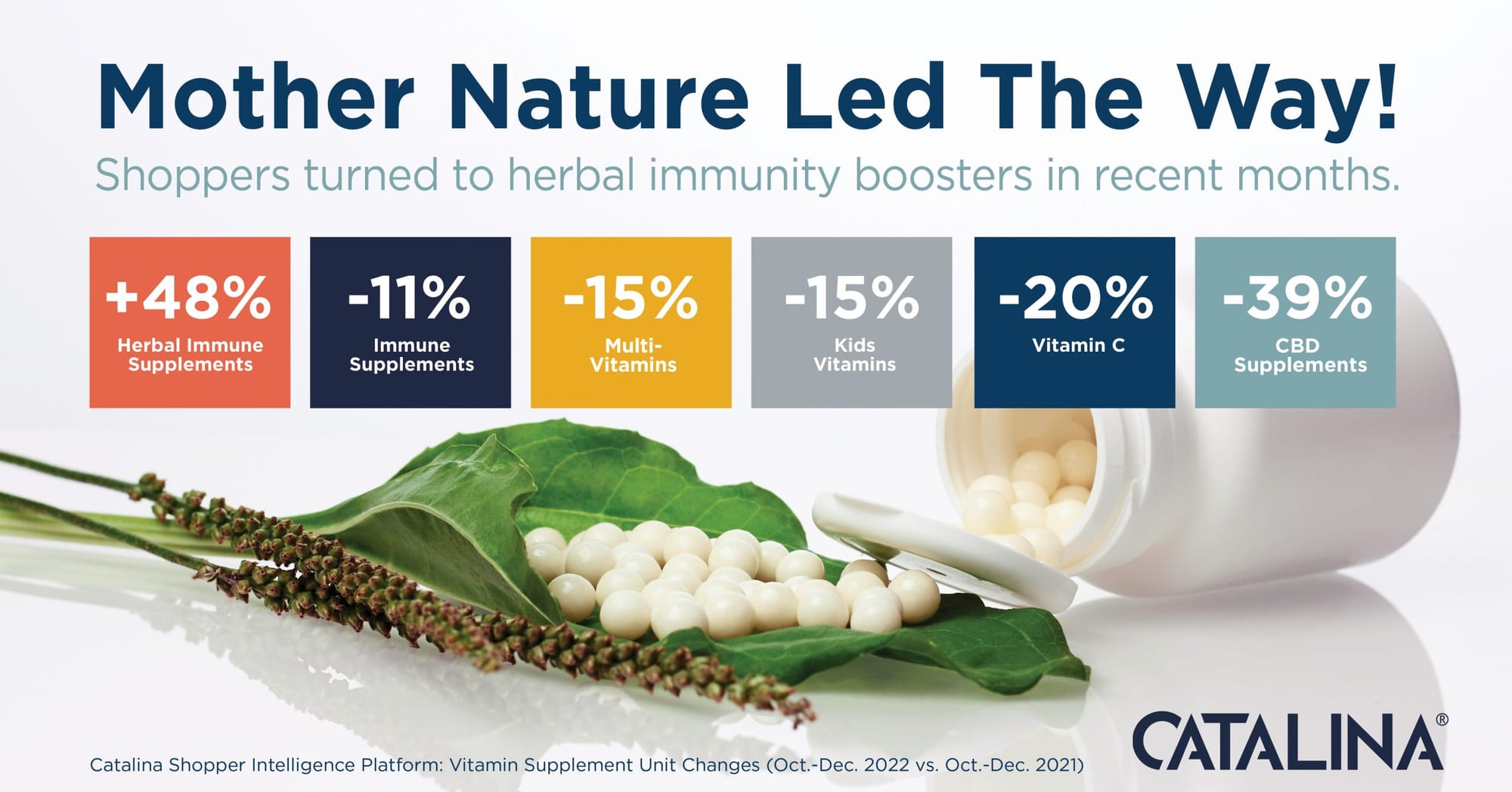

ST. PETERSBURG, Fla. – During the final quarter of 2022, even as the U.S. grappled with a “tripledemic” of flu, RSV and COVID-19, unit sales of vitamins and health supplements declined over the prior year while average unit prices rose, according to shopper intelligence leader Catalina. A clear exception was Herbal Immune Supplements, unit sales of which shot up 48% while their average price declined by 4%.

Rather than vitamins, shoppers instead were prone to spend their money on over-the-counter (OTC) treatment remedies for coughs, colds, flu, fever and aches and pains — common symptoms associated with the tripledemic. Kids Analgesics recorded the biggest jump with unit sales up 67% and dollar sales up a whopping 93%, with average prices increasing by 15%. Adult Cough and Cold was the next highest, with unit sales up 30% and dollar sales up 44%.

| Virus Treatment Category | Unit change over 2021 | Dollar sales change over 2021 | Average Price change over 2021 | |

| Herbal Immune Supplements | +48% | +22% | -4% | |

| Adult Cough/Cold | +30% | +44% | +11% | |

| Nasal Spray | +13% | +19% | +1% | |

| Chest Rubs | +11% | +19% | +7% | |

| Cough Drops | +18% | +42% | +20% | |

| Kids Analgesics | +67% | +93% | +15% | |

| Kids Cough & Cold | +20% | +41% | +17% | |

| External Analgesics | -6% | -1% | +5% | |

| Internal Analgesics | -8% | +3% | +11% | |

| Immune Supplements | -11% | -4% | +7% | |

| Multi-Vitamins | -15% | -6% | +11% | |

| Kids Vitamins | -15% | -7% | +9% | |

| Vitamin C | -20% | -10% | +12% | |

| CBD Supplements | -39% | -49% | -12% |

Source: Catalina Shopper Intelligence Platform, Oct.-Dec. 2022 vs. Oct.-Dec. 2021

The Fall – and Rise — of Immune Supplements

“It’s clear that shopper behavior in recent months very much turned the old adage on its head; an ounce of prevention–often associated with vitamins and immune supplements–was not worth a pound of cure,” said Sean Murphy, Chief Data & Analytics Officer at Catalina, referring to unit sales of Immune Supplements declining 11% while average dollar sales in the category fell 4% vs. the prior year. “Based on historical trends, we expect immune supplement sales to again peak in January thanks to New Year resolutions on health and fitness being top of mind and retailers heavily promoting these brands. In fact, January typically accounts for 15% of annual sales in this category.”

Those who are buying Immune Supplements are willing to pay more for them. Although only 6% of UPCs (Unique Product Codes) for Immune Supplements are considered premium brands, those accounted for 39% of sales during Q4 of 2022. Notably, the unit sales price for premium brands average 25% higher than store brands.

While Herbal Immune Supplement sales soared on a percentage basis compared to sales of traditional immune supplements, these products represent less than one percent of Virus Category buyers overall. Still, Catalina has added Herbal Immunity Seekers to its expansive Audience Catalogue, which includes more than 1,700 pre-built, syndicated segments and hundreds of custom audiences based on real-time purchase data and shopping behavior insights derived from virtually all U.S. households.

What Else is in the Basket?

“We know that Herbal Immunity Shoppers, for example, are prone to also be Antibiotic Avoiders. Among these buyers, 47% are six times as likely to also purchase herbal/chai teas – while 19% also buy organic cheese, which is 16 times the rate of the average shopper,” said Murphy. “These sorts of insights are invaluable when it comes to creating personalized messages and cross-promotional offers that trigger sales and build brands and categories.”