HYDERABAD, India — Dr. Reddy’s Laboratories Ltd. is building a pathway to long-term future growth on a strong foundation of capabilities. The innovation-focused pharmaceuticals manufacturer is well positioned to adapt to the swiftly changing global market and emerging opportunities in health care.

Alok Sonig

According to Alok Sonig, chief executive officer for developed markets, Dr. Reddy’s is committed to widening and accelerating access to affordable medicines by bringing expensive medicines within reach of all patients, addressing unmet needs and helping patients manage their diseases more effectively.

To achieve that, the company operates a multidimensional business model that drives three major businesses: global generic pharmaceuticals (including biosimilars); proprietary prescription drugs and custom pharmaceutical services; and production of active pharmaceutical ingredients (APIs). The major therapeutic areas addressed by its products are gastrointestinal, cardiovascular, diabetology, oncology, pain management and dermatology.

Dr. Reddy’s operates in most major markets across the globe, including North America, Europe, India, Russia and the Commonwealth of Independent States (CIS countries). At present its generic drug business is centered in the United States and European Union, while its branded pharmaceuticals business is focused on India, Russia and emerging markets.

The company also leverages a number of partnerships to extend its market reach, Sonig points out. “We have alliances around the world,” he says. “In India we have partnerships with large multinational companies such as Amgen and we have several asset-level partnerships with multinationals and innovative companies where we have our branded businesses.”

In addition to its multiple strategic alliances, Dr. Reddy’s business rests on a solid groundwork of manufacturing capabilities and highly developed infrastructure. It operates nearly 20 facilities, all of which are are audited by regulartory bodies throughout the globe, including the U.S. Food and Drug Administration, to produce more than 22 billion pills annually.

The company also operates three facilities producing injectables (including complex products), with an FDA-audited oncology facility among them. Ointments are produced in two facilities, including a new one that is dedicated to the U.S. market and has recently been audited by the FDA.

The North American generics business is thriving, with 15 new products launched during the 2018 fiscal year, including many first-wave launches such as Palonostron injection, Sevelamer Carbonate tablets, Ezetimibe & Simvastatin tablets, Doxorubicin Hydrochloride Liposome injection and Levocetirizine. The company expects to file 20 to 25 ANDAs this year, and preparations remain on track for some near-term, big-ticket launches.

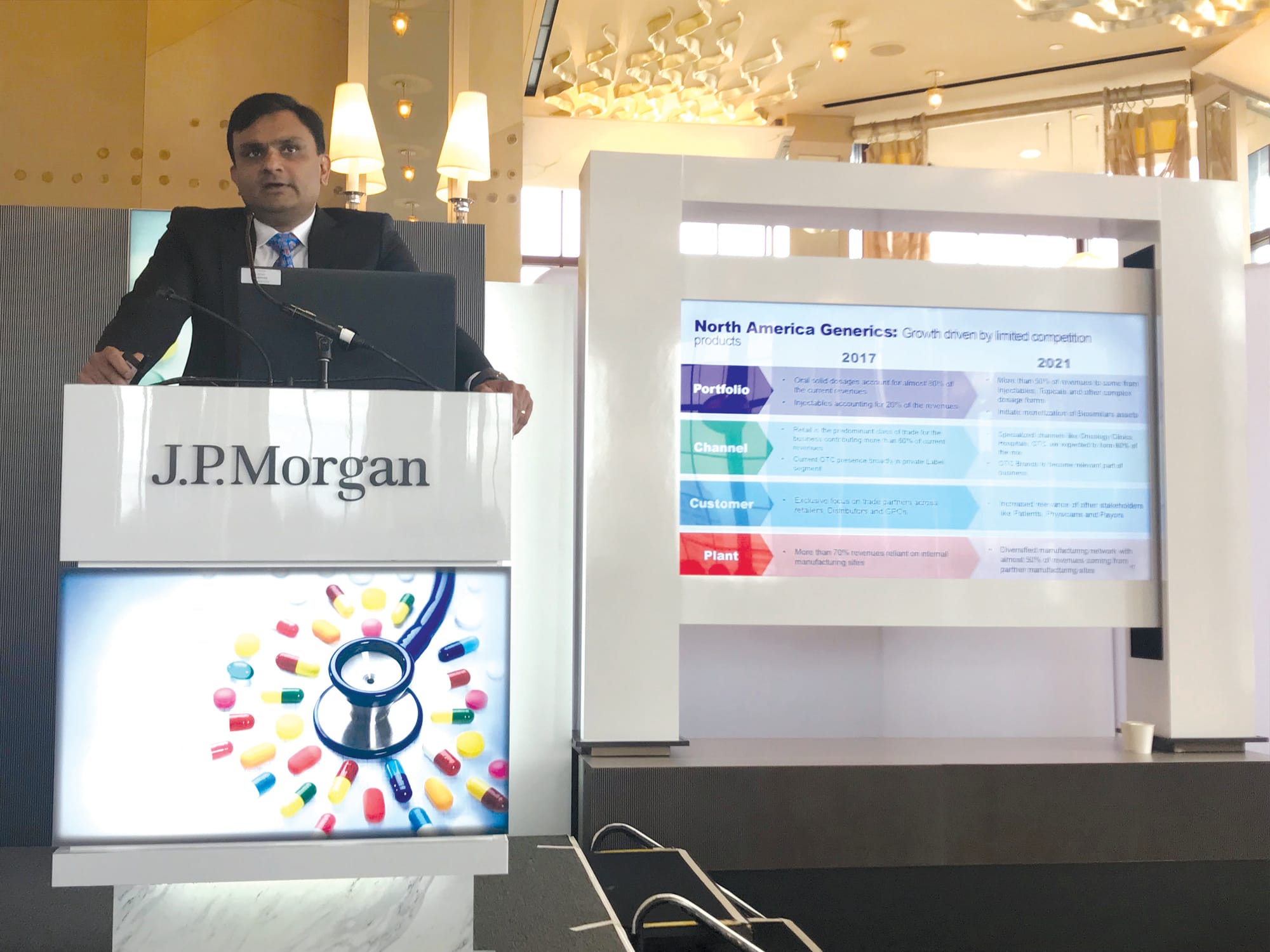

However, the coming years will see significant strategic adaptation to a changing North American generics landscape, according to Sonig. At present, about 80% of the division’s revenues are generated by oral solid dosage products, and only 20% by injectables.

Distribution currently is predominantly through retail pharmacy, which accounts for about 60% of revenues. Dr. Reddy’s also distributes private label over-the-counter medications through the retail channel. More than 70% of North American generics revenues are generated by products produced by company-owned plants.

Sonig addressing the J. P. Morgan Healthcare Conference.

This picture is about to change, however. By 2021, the division plans to gain more than 50% of its revenues from injectables, topical ointments and other complex dosage forms, while it begins to monetize its biosimilar assets in the U.S.

Moreover, with the shift in product emphasis, it will expand its North American distribution to encompass specialized channels such as oncology clinics and hospitals. Along with its private label O-T-C offerings, which will assume a higher profile, these new channels are expected to account for 60% of the sales mix. The manufacturing base will also change, with nearly 50% of revenues coming from products produced by manufacturing partners’ sites.

Finally, while the North American generics business thus far has been focused on its trading partners in retail, wholesale and group purchasing organization channels, going forward more attention will be directed to payers, providers and patients.

Biologics are destined to play a much bigger role globally for Dr. Reddy’s, says Sonig. Through its strategic alliance with Amgen, the company has launched four biosimilar products in India: Vectibix (panitumumab), Xgeva (denosumab), Kyprolis (carfilzomib) and prolia (denosumab), all injectibles. In addition, it has successfully launched oncology biosimilars in emerging markets and the European Union, while Reditux (rituximab), used to treat certain cancers, is now approved in 17 countries and available in 14.

Biosimilars continue to face formidable hurdles in the U.S., however; less than half a dozen have entered the market, in some cases being excluded from the formularies of pharmacy benefits managers. “We need to work with all the stakeholders, including the government and the payors, to make sure they realize the full value of biosimilars and will work with us to create an ecosystem where we can provide value for both payors and for patients,” says Sonig. “There is a real opportunity for generics manufacturers to work with the government and the payor side to ensure that biosimilars reach the patients who need them.”

Dr. Reddy’s also has big plans for a branded business in the U.S. market. Although small at present, it is projected to become a $400 million enterprise by 2022.

“These are differentiated, proprietary products that address significant unmet needs in dermatology and neurology (pain management),” Sonig explains. “We are looking to create a significant branded presence in the U.S. in these fields with products that fill unmet needs.”

This business segment combines a low-risk innovation model with a track record of regulatory and commercial success, he adds. At present two products are in the market: Zembrace SymTouch (sumatriptan injection), a neurology drug, and Sernivo (betamethasone diproprionate) Spray, a dermatological product. Three more dermatology drugs have been approved.

“Accelerating access to innovative medicines and making them affordable for patients is really our vision as a company, and I think there is significant value that we can create for the U.S. health care system,” says Sonig. “We feel that generic manufacturers can invest in and upgrade their capabilities in order to get approval to produce complex drugs, including biosimilars, and bring them to market in a more timely way. And I think it’s important for the industry to engage with stakeholders in Washington when the U.S. health care system is obviously under pressure.”