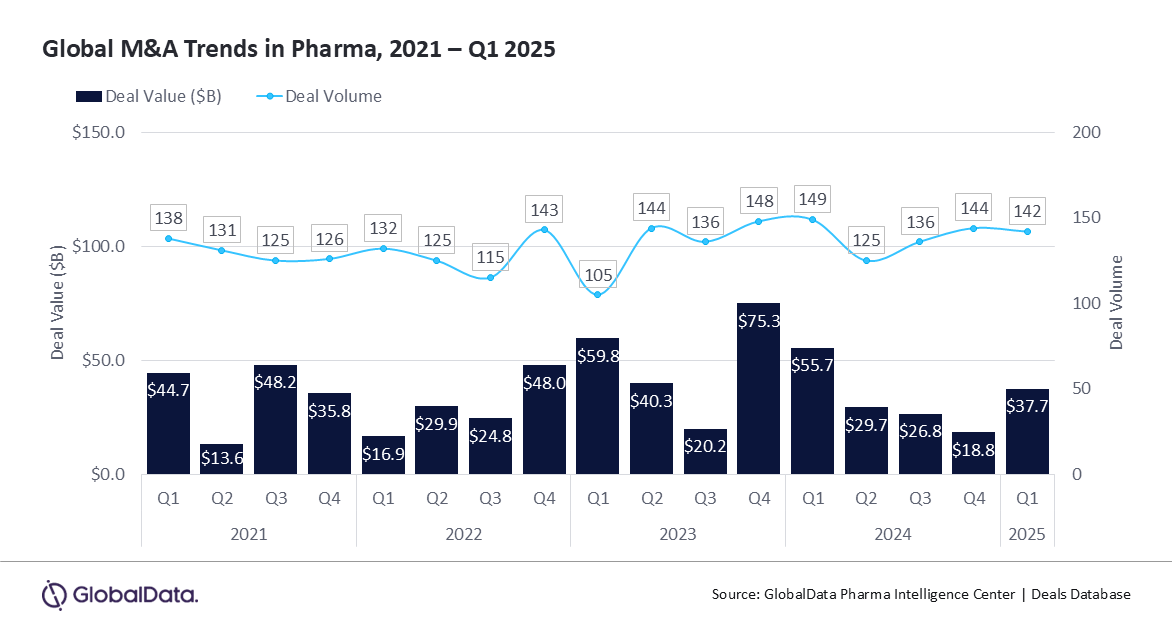

LONDON — Mergers and acquisitions (M&As) in the biopharmaceutical industry surged 101% in total deal value in Q1 2025 from $18.8 billion in Q4 2024 to $37.7 billion. However, drugmakers remain hesitant to pursue larger-scale transactions. The total deal value in Q1 2025 was 32% lower compared to Q1 2024, as larger M&As are seen as high risk due to the current US political landscape, according to GlobalData, a leading data and analytics company.

According to GlobalData’s report “Pharma M&A Trends – Q1 2025,” oncology remains the leading therapeutic area in Q1 2025, with most of the deals targeting cancer-related assets.

While billion-dollar acquisitions remain rare due to the current political turbulence, during Q1 2025, big pharma was involved in four billion-dollar deals valued at $1 billion or more, according to GlobalData’s Pharmaceutical Intelligence Center Deals Database. These included Johnson & Johnson’s $14.6 billion acquisition of Intra-Cellular Therapies, Novartis’ $3.1 billion acquisition of Anthos Therapeutics, GSK’s $1.15 billion buy of IDRx, and AstraZeneca’s $1 billion purchase of EsoBiotec.

Ophelia Chan, Senior Business Fundamentals Analyst at GlobalData, comments: “Apart from a flurry of large-scale deals driven by big pharma, the industry remains cautious given the uncertainty surrounding Trump’s as-yet-unspecified policies. So far, the start of 2025 continues to be shaped primarily by bolt-on transactions.”

Chan continues: “Dealmakers are closely monitoring further details of new policies and awaiting greater clarity on forthcoming regulations. Some companies may adopt a wait-and-see approach, holding off on transactions until there is more insight into how Trump’s tariffs will affect industry, while others are awaiting what the administration will say on M&As.”

Chan concludes: “Given that deregulation was a defining feature of Trump’s first term, it is anticipated that the administration will pursue measures to ease regulatory constraints. Such efforts aim to accelerate the M&A regulatory process, sparking more mega deals and overall increase in M&A activity.”

To view further insights into M&A activity globally in Q1 2025 in the Pharma Sector, please see our Pharma M&A Trends – Q1 2025 report.