NEW YORK — Holiday sales at drug chains edged up slightly versus a year ago, as uncertainty over the economy left consumers wary of boosting their spending.

Another crimp on sales growth was deep discounts. While retailers trimmed inventory for the holiday season to avoid having to clear out overstocks with price cuts, consumers were still expecting deals.

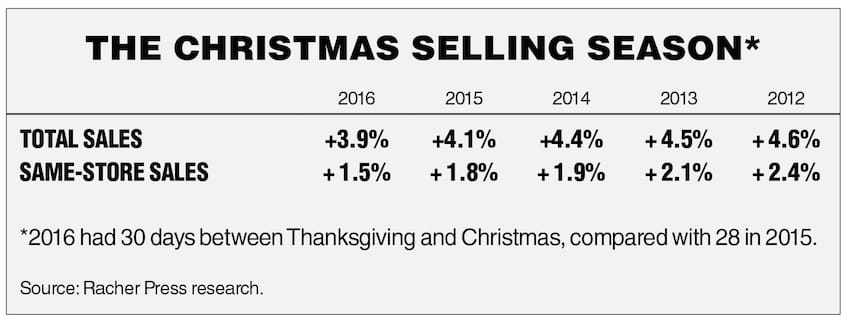

For chain drug retailers, holiday sales rose an estimated 3.9% year over year, down from 4.1% growth in the 2015 holiday shopping season, according to research by Racher Press Inc., the publisher of Chain Drug Review. Same-store sales for the 2016 season inched up 1.5%, just short of the 1.8% growth in 2015.

The lesser sales growth this holiday season came despite more shopping days. The 2016 season had 30 days between Thanksgiving and Christmas versus 28 days in 2015.

Shoppers favored chains that offered promotions, said John Squire, chief executive officer of DynamicAction Inc. The company’s analysis of $4 billion in online purchases found that the number of discounted transactions rose by virtually four-fifths from a year earlier.

Accenture’s Holiday Shopping Survey found that 72% of consumers would shop at stores they didn’t usually go to if they could get a deal. Additionally, two in three said they would purchase items from multiple stores or websites to get the lowest price.

Chain drug retailers were also hurt by the continuing encroachment of e-tailers.

Most of the people surveyed for Accenture said they expected to do the majority of their shopping online. On the other hand, purchasing online with in-store pickup was singled out as a major benefit for almost half of respondents compared with a year earlier, when just 36% mentioned such an offer as a benefit. That is welcome news for CVS Pharmacy and Walgreens, both of which have launched click-and-collect offerings.

For all the hoopla around Black Friday and Cyber Monday, a later date continued to emerge as a shopping magnet. Nearly 156 million people were planning to or considering taking advantage of Super Saturday sales to complete their holiday gift list, according to the National Retail Federation and Prosper Insights & Analytics.

An NRF survey found that more people said they planned to shop on Super Saturday, December 17, than had said in an earlier survey that they planned to shop over Thanksgiving weekend.

“While many consumers got a head start with holiday shopping by taking advantage of extraordinary sales over Thanksgiving weekend, more shopping and great deals are yet to come,” NRF president and chief executive officer Matthew Shay commented. “We expect retailers will once again be competitive on price and value options in the final stretch, especially on Super Saturday.”

As of mid-December, as in previous years, only one in 10 consumers — 24 million people — had finished their holiday shopping. That meant 90% of holiday shoppers had gifts, food, decor and/or other holiday items still to buy. The average holiday shopper had completed 52.5% of their shopping, down from 53.5% in 2015.