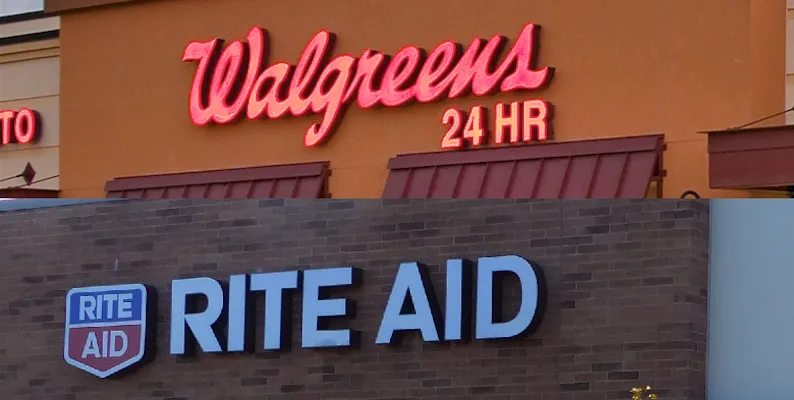

DEERFIELD, Ill. — The consolidation of chain drug retailing climaxed last month with Walgreens Boots Alliance Inc.’s (WBA’s) acquisition of Rite Aid Corp.

In the largest outright purchase of a chain in the industry’s history, WBA agreed to acquire Rite Aid for $9 per share, or $17.2 billion, including debt. The price represents a premium of 48% over Rite Aid’s closing price on October 26, the day before the deal was inked.

The Walgreens-Rite Aid merger transaction is expected to close in the second half of 2016.

The acquisition adds Rite Aid’s nearly 4,600 stores in 31 states to Walgreens’ 8,173 nationwide, although closings will be required to meet antitrust regulations. Worldwide, WBA has over 13,100 outlets in 11 countries. Rite Aid had fiscal 2015 revenues of $26.5 billion, compared to WBA’s net sales of $103.4 billion.

The deal leaves Walgreens and CVS/pharmacy at the top of the industry with no other pure-play drug chain in sight. “The pharmacy consolidation endgame has begun,” said consultant Adam Fein, chief executive officer of Drug Channels Institute.

Stefano Pessina, CEO of WBA, said the company knew it needed to increase its presence and coverage nationally. “This combination will further strengthen our commitment to making quality health care accessible to more customers and patients,” he said. “Our complementary retail pharmacy footprints in the U.S. will create an even better network, with more health and wellness solutions available in stores and online.”

WBA will bring Rite Aid its global expertise and resources to accelerate the delivery of integrated frontline care and offer innovative solutions for providers, payers and other entities in the U.S. health care system, Pessina said. “Finally, this combination will generate a stronger base for sustainable growth and investment into Rite Aid stores, while realizing synergies over time.”

Rite Aid chairman and CEO John Standley said the deal will enhance the Pennsylvania-based chain’s ability to meet the health and wellness needs of customers while delivering significant value to shareholders.

“This transaction is a testament to the hard work of all our associates to deliver a higher level of care to the patients and communities we serve,” Standley stated. “Together with Walgreens Boots Alliance, the Rite Aid team can continue to build upon this great work through access to increased capital that will enhance our store base and expand opportunities as part of the first global pharmacy-led, health and well-being enterprise.”

Asked how much Rite Aid’s acquisition this year of pharmacy benefits manager EnvisionRx figured in the deal, Walgreens president Alex Gourlay said during a conference call that EnvisionRx was “a relatively small PBM” that could help provide an understanding of pharmacy access. “But clearly we need to understand more, and we’ll understand more once we’re through” with the Federal Trade Commission’s review of the deal, he said.

“In any case, it will be a good opportunity for us to learn more,” said Pessina. “And we are always open to learn.”

Consultant Fein noted that Rite Aid hadn’t executed on any new preferred network offerings or specialty pharmacy strategies. “Therefore, the EnvisionRx potential still exists.” But the conference call comments suggest that “WBA’s management team has a clear retail mind-set but lacks experience with payer businesses,” Fein said.

WBA’s added scale could provide some countervailing power in its negotiations over network access and reimbursement rates, he added. “For instance, the company may have to offer smaller discounts to participate in preferred networks.” But the acquisition was ostensibly motivated by internal and financial synergies, rather than a desire to increase negotiating power, Fein noted.

The boards of both companies have approved the transaction, which is subject to approval by Rite Aid stockholders, the expiration of applicable waiting periods under the Hart-Scott-Rodino Act, and other customary closing conditions.

The deal is expected to be accretive to WBA’s adjusted earnings per share in its first full year after completion. Additionally, WBA expects to realize synergies in excess of $1 billion. While some of those are relatively easy to identify, “others will require investment and will take time to deliver,” said global chief financial officer George Fairweather.

“Clearly, we are very confident that taking everything into account, the transaction will be suitably accretive for us,” commented Fairweather. “We have been prudent in our assumptions for the business and have been realistic about our expectations for the markets in which we operate.”

Rite Aid is expected to initially operate under its own name. Decisions will be made over time regarding the integration of the two companies to create a fully harmonized portfolio of stores and infrastructure.

WBA expects to finance the transaction through a combination of cash, assumption of Rite Aid debt and issuance of new debt.

Pessina said the deal is another step in WBA’s global development and continuation of its profitable growth strategy. “In both mature and newer markets across the world, our approach is to advance and broaden the delivery of retail health, well-being and beauty products and services,” he said.