The year is not starting with a bang, but with a slow and uncertain step forward. Inflation is still rising; the threat of a recession looms on the horizon. So how are CEOs approaching 2023? What will the year hold for health and wellness companies?

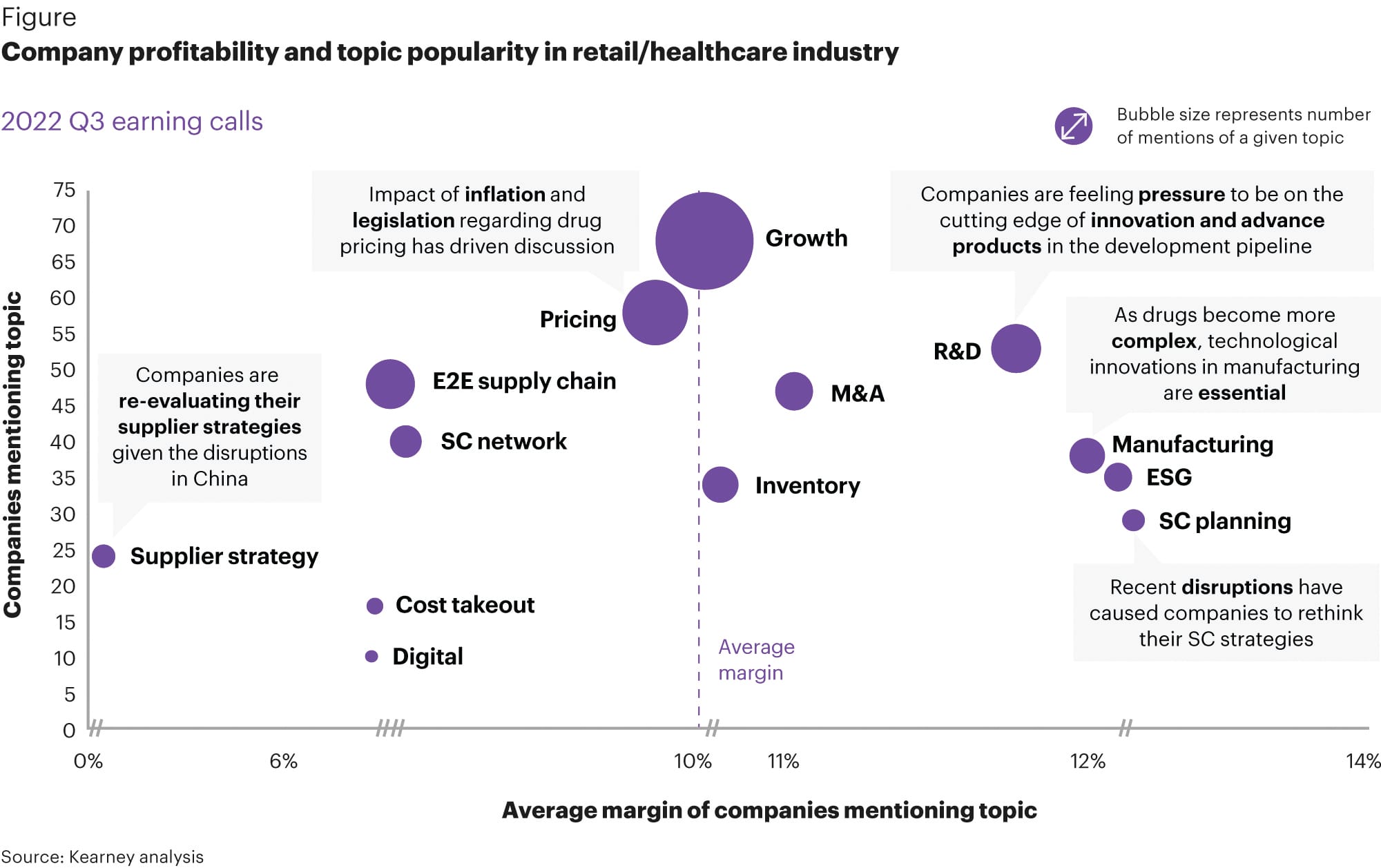

To get a view of major corporate project priorities in 2023, Kearney did an extensive analysis of public documents (earnings calls, CEO surveys, news articles, press releases and industry reports) and its health and wellness project pipeline. Here’s a look at the focus areas at the top of health and wellness CEOs’ priority lists in 2023.

Cost improvement remains at center stage

Todd Huseby

Not unexpected, our research shows that companies are actively pursuing cost-improvement programs and insulating their operations against the impacts of a potential recession. When looking at their public comments in late 2022, 65% of CEOs said they expect to take financial or budgetary actions. Not surprisingly, pricing is also a frequently mentioned topic, surely driven by the impacts of inflation and legislation regarding drug pricing. Many are also reevaluating business priorities and decreasing spending on nonessential operational programs, including ESG, digital and M&A. Around 50% of CEOs are pausing or reconsidering their ESG efforts. Seventy-five percent of CEOs have plans to pause or scale back their digital transformation strategies — or more accurately, are focused on embedding digital into the rest of the business rather than on digital itself. And companies are taking a “wait and see” approach to M&A.

As companies’ costs are rising and CEOs work to constrain budgets, there’s also the need to continue to focus on retaining employees in a hot labor market. While layoffs in the tech and banking sectors have dominated headlines, the total percentage of the workforce impacted by those layoffs is very low, and unemployment remains at a 50-year low. Therefore, employee retention remains a key focus. If budget restrictions mean employers can’t increase worker compensation, the answer likely lies in improving the workplace, remote work, and/or benefits experience. In particular, the chain drug industry is experiencing shortages of pharmacists and pharmacy techs. As a result, companies will need to devote resources and attention to assuaging pandemic-fueled burnout and retaining these key talent groups.

Growth projects are driving buzz

Karen Yocky

Given the threats of recession, we were surprised that the most-cited kinds of projects by CEOs are growth projects. Around 50% of the earnings calls we analyzed mentioned growth, largely dominated by higher-margin organizations — that’s twice as much as a year ago.

Other projects cited that support growth goals included R&D and M&A.

• R&D: Companies feel pressure to be on the cutting edge of innovation and to advance projects in the development pipeline. In health care, the growth areas often cited were oncology and geriatrics. Interestingly, companies that cited R&D were also among the most profitable companies in our scan.

• M&A: Despite the frequency of M&A mentions, actual transactions year over year were down roughly half, a result of slowed investments, particularly from private equity firms. However, with lower valuations, perhaps M&A activity could pick up as we move through 2023. Those public companies that are focusing on M&A are doing so to improve margins and fill gaps in corporate portfolios.

Supply chain is still an area to improve and expand

Stuart Klein

We also saw continued emphasis on supply chain improvement and expansion. This has clearly been a challenge over the past few years. And leaders are still prioritizing supply diversity and resilience, as they have been for over a year now. Other supply chain priorities include inventory management, cost optimization, and in-sourcing (moving to domestic production) to shorten supply chains and increase agility.

Retail pharmacies in particular are focused on last-mile delivery, fully automated distribution centers and footprint adjustments to expand their networks while managing costs.

Companies are investing in data science and AI to simplify and automate supply chains. Consumer demand shifts are necessitating companies layer in demand sensing, optimization, and advanced capabilities to quickly recognize demand shifts and adjust orders, inventory plans and logistics. Leaders are increasingly understanding the consumer and adjusting to their needs.

Digital and ESG take a backseat

When faced with uncertainty, CEOs are paying less attention to digital initiatives and environmental, social and corporate governance (ESG) projects.

To emphasize points mentioned earlier, CEOs generally did not discuss digital for digital’s sake as a priority as frequently as they have in years past (in fact, only 14% mentioned “digital” on earnings calls). In most cases, leaders and/or investors now seem to understand digital as a means to an end (goals like customer engagement and supply chain improvements), not a discrete goal in itself. As mentioned in the first section, as technology has gotten more sophisticated, digital underpins all business initiatives — it’s not a separate line item.

Finally, despite their prevalence as a central topic at the recent World Economic Forum in Davos, ESG and sustainability were not cited as core priorities as frequently as in years past. While commitments to ESG and sustainability targets have doubled each year over the past six years, companies often struggle to meet these targets. And in uncertain times, spending to achieve these goals has become deprioritized. The top two challenges to achieving ESG goals reported by CEOs were lack of knowledge and lack of prioritization.

In conclusion, the consensus from CEOs across industries is a push for growth while remaining resilient in the face of a potential recession. Despite the uncertain future, the leaders we have presented in this material are generally optimistic that their businesses’ programs will succeed and even drive growth in 2023. If we have learned anything from the tumult of the past few years, it’s that resilience matters. Keeping an eye on long-term, sustainable success is key for any leadership team assessing near-term priorities.

Todd Huseby is a partner in the health practice at Kearney, a strategy and management consulting firm. He can be reached at todd.huseby@kearney,com. Stuart Klein is a partner in the analytics practice at Kearney. He can be reached at stuart.klein@kearney.com. Karen Yocky is a manager in the health practice at Kearney. She can be reached at karen.yocky@kearney.com.