NEW YORK — I grew up in a very small town, Yardley, Pa., in the 1970s. Main Street, “downtown,” had only one pizza place (Vince’s), one convenience store (WaWa) and no movie theater. We did, however, have two drug stores less than 150 yards from each other. In the 20 years that I lived in Yardley, I never stepped foot in Hyatt Pharmacy. We were a Phil’s Pharmacy (actually named Yardley Pharmacy) family, and like Coke vs. Pepsi or Colgate vs. Crest you made your choice and you stuck with it. Phil kept better records than we did. He was often the “first opinion,” which I’m sure frustrated many of the area doctors. He knew what was new. In short, our pharmacist was just that: our pharmacist.

Steven Robins

While the composition of pharmacy ownership has changed dramatically, it has never been more important for the welfare of patients and for the health of the channel to reestablish the primary role that the pharmacists in chain drug should play in educating, connecting with and protecting our patients and their caregivers. Today this has to include a combination of high-touch and digital options designed to support customers looking to understand their best options for maintaining their health.

An increasingly complex population

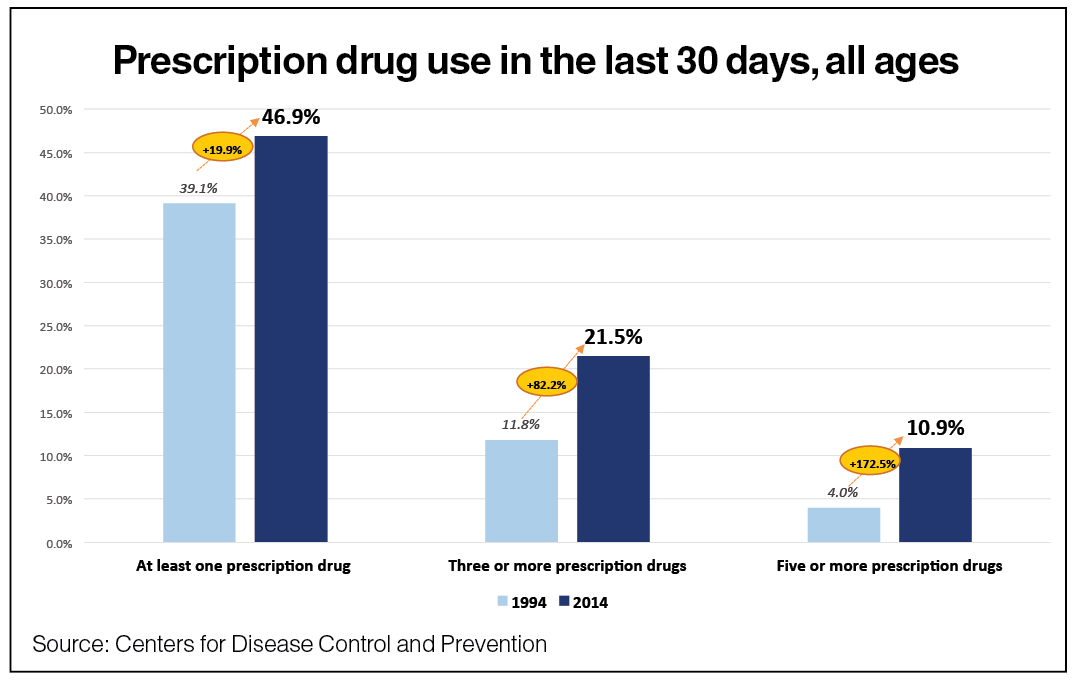

Demographics and lifestyles have intersected to create an increase in the patient population taking prescription drugs on a 30-day basis. Further, according to the Centers for Disease Control and Prevention, more and more patients are taking multiple prescriptions. In fact, over one in nine Americans are taking five or more prescriptions, a 270% increase from 20 years ago. for older patients that percentage has soared, more than tripling in a single generation. Today, nearly 40% of seniors are taking five or more prescriptions. The increase in prescriptions mirrors the high level of multiple chronic conditions today, with 25% of the population managing at least two conditions.

Chain drug is in the unique position of being able to offer patients a comprehensive understanding of drug interactions as well as explaining the advantages and disadvantages of the over-the-counter drugs, nutritional supplements and diet products that patients are buying to supplement their regimens.

Competition from outside

Even before Amazon made its offer for PillPack, the competition for pharmacy information and dollars from outside the chain drug channel was increasing. Specialty hubs, mail order pharmacies and several of the new adherence and compliance apps have the potential to move prescriptions out of the retail channel. While there is some resistance to going digital among patients over age 50, recent research indicates that 51% of them have digital health portals. These low-touch solutions can be efficient, but they can rob the patient of complete information and they pose a threat to the front of the chain drug store as well as the pharmacy.

As pharmacy transactions move to mail order or specialty pharmacy, it can impact traffic and will have a negative impact on the value of the market basket. The work that chain drug has done to build out complementary solution sets for diabetes, weight loss, and infant nutrition and care becomes less relevant for those who are sourcing elements of those solution sets elsewhere.

While chain drug programs deliver savings and information via loyalty apps, there remains tremendous opportunity to leverage big data that results in tailored 360-degree promotion and simplified tracking. Further, today’s loyalty programs are focused on front-end transactions when, for those patients who have opted in, the opportunity to learn something new from the pharmacist about managing their conditions can be of great value.

A trusted resource

The good news is that pharmacists remain among the top five professionals when it comes to perceived trustworthiness and ethics. Over 60% of us believe that our pharmacist has high/very high honesty and ethics, and nine in 10 rate them as average or better. Further, the New England Consulting Group (NECG) has found that patients and caregivers who have spoken directly with a pharmacist consider themselves more confident that they understand the risks and benefits of a medication than those who rely on their doctor only or on online information sources. In fact, in many cases, patients have told NECG that while they understood a primary diagnosis of a significant condition, there were other, related conditions they were never told about initially by their doctor.

Programs that work

At NECG, we are moderately optimistic that chain drug is beginning to leverage the power of the pharmacist with programs that can be highly effective in starting patients on drug therapies and keeping them on them longer. We have evaluated a number of chain pharmacy programs on behalf of our clients and, when properly structured with accurate targets, these programs have been shown to contribute to significant improvements in patient compliance.

These improvements have a beneficial effect across the health care ecosystem, in many cases reducing hospitalization and readmissions for severe symptomatic episodes. Beyond that, they offer an opportunity for a retailer to build deeper loyalty with growing segments of the population.

Finally, until “bots” are the only educational resource, the real human pharmacist offers chains the unique alternative to point-and-click health care that they need to stay relevant.

Steven Robins is a managing partner and principal at the New England Consulting Group. He can be reached at sfr@necg.net.