As of 2017, 45% of the global population was using the internet, and it is projected that 76% will have access by 2030, according to Euromonitor International. With more connectivity, a new type of connected consumer is rising: the digital health consumer.

Carolina Ordonez

Digital health consumers are emerging as a significant cohort within the consumer health marketplace, and are more frequently tracking their health and fitness while buying more consumer health products online. This consumer is hard to engage with, but companies can now access new ways to leverage social media, health apps, micro-influencers and voice commerce to capture consumers’ attention, especially in markets where the digital health consumer is ascendant.

The common path for a digital health consumer starts with increasing interest and access to health education and advice via digital devices. From this, some consumers begin to track health and fitness through mobile apps, and use apps to fill prescription orders for pickup (or delivery) rather than doing so in person, among other activities.

During this process, the digital health consumer chooses to purchase consumer health products online. As a result, this consumer increasingly expects consumer health companies to understand her/his health needs quickly and demands personalized customer service based on the data they already provide.

Rise of prevention

Whether a digital health consumer is in China trying to get health advice through an app or in the United States tracking fitness goals on a smart watch, they are becoming more informed about their health, either in the form of basic health questions posed through Google; by heading directly to such health websites as WebMD, Mayo Clinic and MedicineNet; or by asking questions via mobile health apps such as Ada Health and Your.Md — all while tracking their health data. These consumers are also comfortable getting information and health advice from social media, where daily polls asking friends about health issues are becoming common practice.

Despite the emergence of a more empowered digital health consumer, who is not only more informed but also more focused on prevention via digital tools, creating meaningful customer engagement has become one of the hardest challenges for consumer health care companies, especially considering the fact that digital health consumers want as much control as possible, and feel that they have the tools to be their own “doctor.”

Use of digital health tools

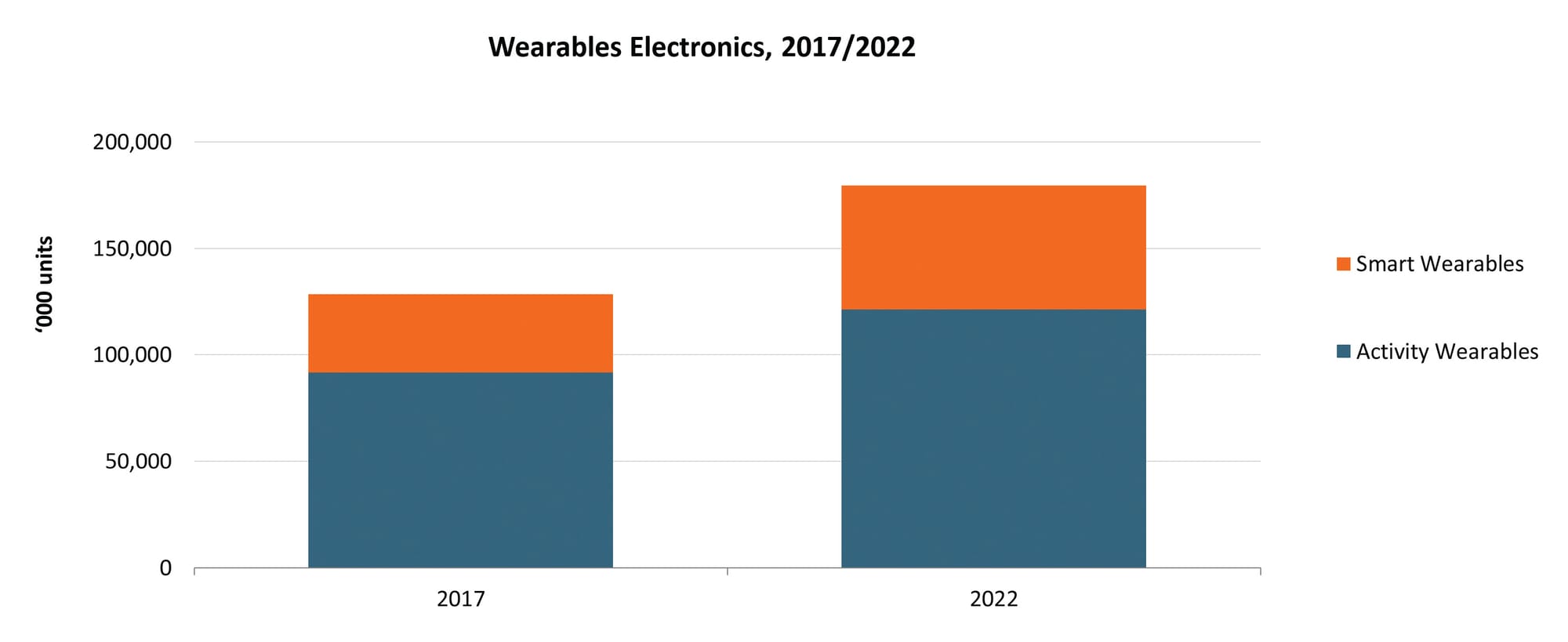

More digital health consumers are using smart wearables and activity wearables to track health stats and physical activities. Sales of these wearables are projected to increase at a combined compound annual growth rate of 9% from 2017 to 2022, reaching $28.6 billion, according to Euromonitor.

Furthermore, consumers are increasingly using health or fitness apps to track their health. This is especially the case with those ages 15 to 29, 19% of whom report “almost everyday usage” of these products in 2017, versus 6% of the 60-plus generation, according to Euromonitor. Both health apps and wearables are starting to be integrated into more personalized consumer health experiences and products.

Educated consumers most likely to monitor health

Consumers with a higher level of education, particularly college graduates and beyond, are leading the way in the use of mobile and digital devices for health research and monitoring. They are likely to have a higher income and therefore have the money for a modern smartphone with internet access. Moreover, this segment has the time to be more conscious about their health, and to access more health education because their basic needs have been met.

Weight management is the most common health monitoring behavior, regardless of education, and in recent years more consumers have turned to health and fitness apps — whether on a smartphone or separate wearable device — to aid them in their quest to lose weight and improve wellness.

Vitamins, supplements drive online sales

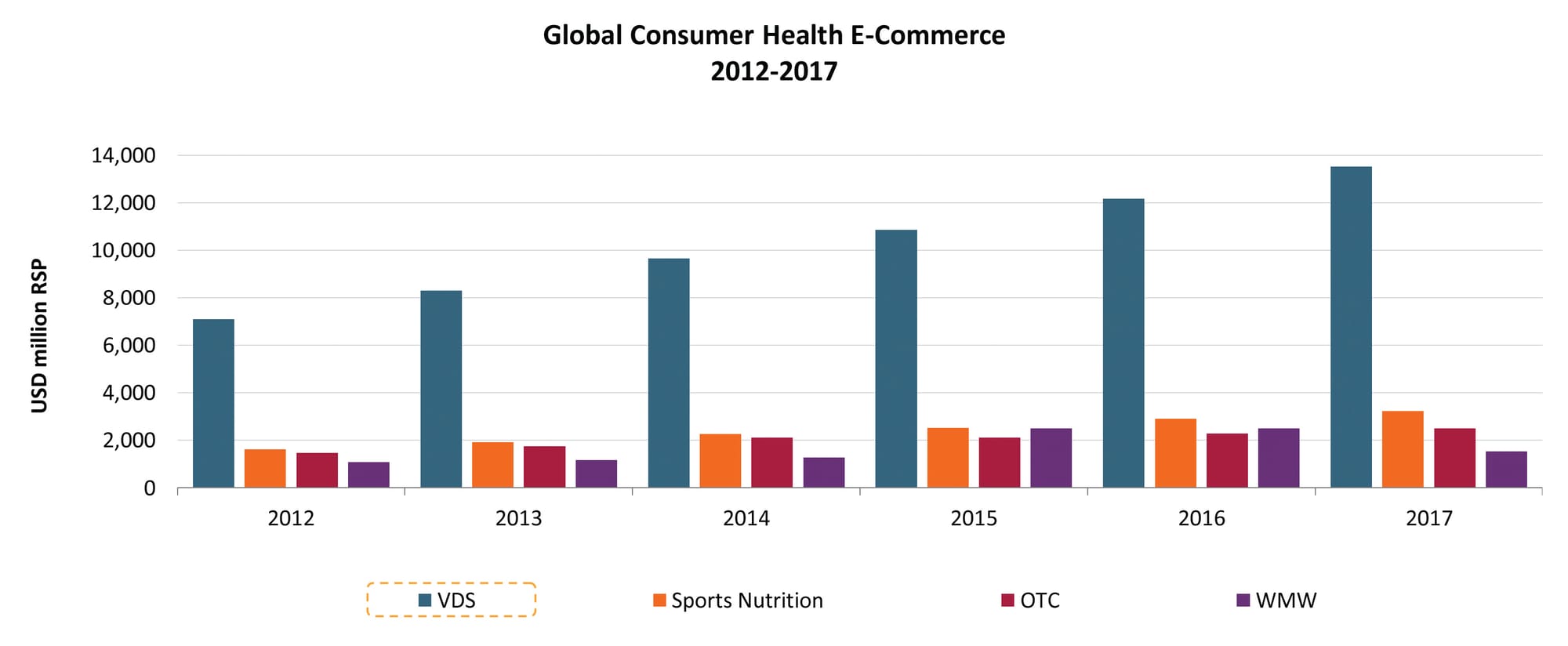

Digital health consumers are shopping online more often, with the majority of online consumer health sales coming in the form of vitamins and dietary supplements (VDS). The over-the-counter industry is further behind, from both a regulatory and a usage perspective.

When consumers require an O-T-C drug, they tend to need it for immediate use to alleviate symptoms, rather than choosing to wait for a product to be shipped. Nevertheless, a small but increasing number of consumers are using pharma apps to buy O-T-C and prescription medicines for pickup or fast delivery.

Global VDS sales through e-commerce almost doubled between 2012 and 2017, rising from $7 billion to $13.5 billion, according to Euromonitor. This rapid online growth also reflects the upsurge of many online VDS startups, which means that digital health consumers are gaining access to a bigger pool of companies. While this is making competition tougher, it is also pushing companies to get more creative when trying to capture these digital consumers.

In 2017, consumer health online sales were still only a fraction (9%) of total consumer health sales, but this channel is expected grow fast, led by digital health consumer demand for VDS, due to convenience and the easier access to a wider variety of VDS products. China and the U.S. lead VDS online sales, with a combined share of 74% ($10 billion) in 2017, according to Euromonitor.

Digital health consumers reshaping the industry

Digital health consumers are buying more consumer health products online, while accessing health education, tracking health and fitness with digital devices, and using apps to fill in prescription orders for pickup (or delivery). Thus, it is not just about going to the retail store anymore.

These consumers expect health care companies to understand their health needs quickly. Consumer health companies must have the ability to show up in mobile searches before the consumer even goes to the store, if they go at all; stay relevant once the consumer hits the store (or e-commerce platform); and engage after the purchase, while being attractive enough, timely, seamless and able to fulfil their health promises.

Carolina Ordonez is a senior consumer health analyst at Euromonitor International.